The second quarter of 2025 showcased both the resilience of financial markets and their sensitivity to policy uncertainty. From the White House’s tariff announcements in April to escalating tensions between Israel and Iran in June, investors faced many challenges. Yet, the stock market went on to stage one of the fastest rebounds in history and finished the quarter at new all-time highs.

Overall, it was a strong quarter for stocks, while bonds also delivered positive outcomes. For long-term investors, these events are a reminder that while headlines can drive short-term swings, maintaining perspective and staying focused on fundamental trends remains the key to achieving financial goals.

Despite significant volatility, the stock market recovered quickly once the worst-case scenarios for tariffs and geopolitical tensions did not materialize. The quarter began with heightened uncertainty following the announcement of new tariffs on April 2, which were more far-reaching than many investors had anticipated. However, as the administration engaged in negotiations and reached preliminary trade agreements with several partners, market sentiment improved. The Middle East conflict created a similar outcome, although markets were broadly resilient and went on to new highs after the ceasefire between Israel and Iran was announced.

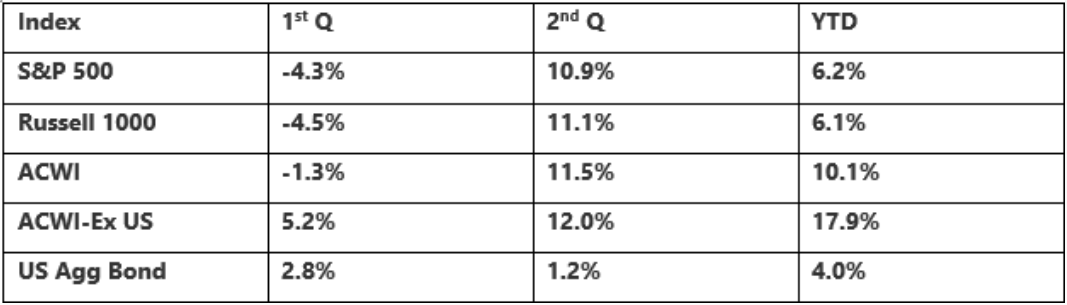

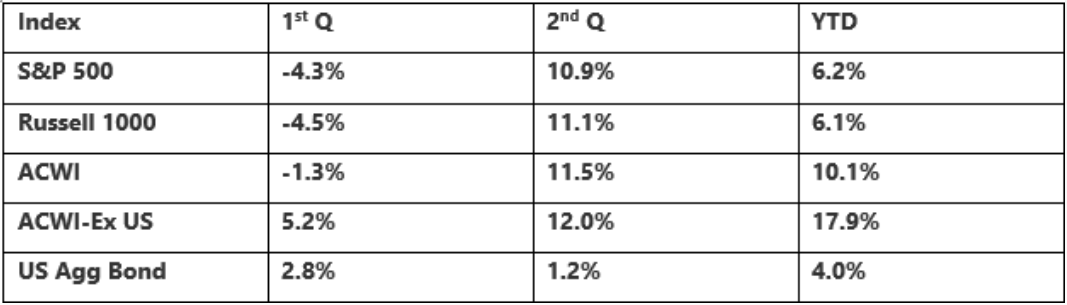

The equity market rebound was widespread, with many sectors, styles, and regions delivering positive outcomes. For US markets, returns were propelled by the mega cap companies which are back to trading at all-time highs. The US market is being pushed higher by industries and companies which have strong visibility like AI and cloud infrastructure growth, market leading consumer mind/activity shares, and US leading capital market activities. Meanwhile, small cap stocks have lagged other parts of the market due to their greater sensitivity to tariffs and domestic trends, and the Russell 2000 index is still down -2.5% this year.

Market Performance:

Despite the dramatic rebound in US stocks, international stocks continue to lead the way in 2025, especially with the dollar weakening. European stocks outperformed their US peers by the biggest margin on record in dollar terms during the first half, the most dramatic sign of how the region’s markets are staging a comeback after more than a decade in the doldrums.

US bond markets are also quietly contributing to portfolio outcomes, with relatively strong yields and falling credit spreads contributing in the quarter. Treasury securities and corporate bonds also experienced volatility during the tariff-induced drawdown, although the quarter ended in positive territory.

Outlook – Elevated market expectations raise investment risk and benefits of diversification

US Economic Forecast: Tariff tweaks continue to add uncertainty

The collective impact of tariffs and tariff uncertainty, federal government cutbacks and declining immigration and tourism, may set up the slowing of the U.S. economy in the second half of the year absent adjustments in imports and export data. However, passage of the reconciliation bill should inject stimulus into the economy, both through lower income tax withholding from the third quarter on and, more powerfully, via very strong income tax refunds in 2026. This should boost economic activity in the first half of 2026. However, growth may slow again in the second half of 2026 as the refund effect fades and the effects of higher tariffs and lower immigration linger.

So far, the impact of tariffs on inflation appears to be minor, with year-over-year CPI inflation coming in at just 2.4% in May. However, the inflationary impacts of tariffs may just have been delayed, not cancelled, and, as retailers apply mark ups to new inventories, consumer prices could see some significant increases. By the fourth quarter, inflation may rise to 3% or more, year-over-year. This inflation could be sustained into early 2026 due to the impacts of higher income tax refunds on consumer spending. However, as the economy slows again in the second half of 2026, inflation should gradually return to the Fed’s 2% target.

Monetary Policy: A data dependent Fed looks to the future

After cutting rates by 1% in the second half of last year, the Federal Reserve has maintained the federal funds rate in a range of 4.25% to 4.50% throughout the first half of 2025. Market expectations are that the Fed remains on hold at least over the next few months and perhaps deliver just one 0.25% rate cut by the end of the year for two key reasons: First, there remains very significant uncertainty on the final shape of federal government policies on tariffs, immigration and the budget and the impact of all of these policies on inflation over the rest of 2025 and in 2026. Second, according to their Summary of Economic Projections, by the end of 2025, they expect the inflation rate to be further above their 2% target

than the unemployment will be relative to its 4.2% long-run expectation. In this scenario, it is hard to justify aggressive Fed easing. However, the Fed could cut more, if the economy slows again in the second half of 2026

Fiscal Policy: How the Big Beautiful Bill could affect the economy

Budget discussions in Washington brought renewed attention to America’s fiscal trajectory. The national debt now exceeds $36 trillion. According to the Congressional Budget Office, the latest budget proposal could add an estimated $3.3 trillion in deficits over the next decade. While the proposal includes spending reductions, these are outweighed by tax cuts and spending increases elsewhere. Moody’s downgraded the U.S. credit rating in May, citing concerns about successive administrations and Congress failing to address “large annual fiscal deficits and growing interest costs.” For long-term investors, these fiscal debates underscore the importance of maintaining diversified portfolios that can weather various policy outcomes. While deficit levels deserve attention, history suggests that the U.S. economy’s fundamental strengths and adaptability remain intact.

US Equity: Valuation may limit near, and longer-term equity returns

One glaring anomaly at the start of this year was the huge outperformance of the largest companies in the S&P500, both in terms of earnings and equity market gains. Much of this reflects the dominant market position of U.S. tech firms and a surge of interest in and investment spending on artificial intelligence. That being said, in recent years, the stock market performance of these companies had generally outpaced their outperformance in earnings, leaving their valuations at generally very high levels relative to the rest of the market. Despite huge market volatility during the second quarter, this anomaly persists today with the top 10 companies in the S&P500 representing well over 35% of the market value of the entire index. For long-term investors, it may make sense to increase allocations to other areas of financial markets in case, economic, geopolitical or idiosyncratic forces weighs on the mega-cap U.S. equity boom.

International Equity: Outperformance could

The first half of 2025 has seen international stocks outperform their U.S. counterparts by a wide margin as local-currency outperformance has been amplified by the impact of a falling dollar. This trend may be poised to continue. First, non-U.S. stocks still carry much lower valuations than their U.S. counterparts. Second, the dollar remains over-valued given trade fundamentals and may be expected to fall in the years to come. Third, given the outperformance of U.S. stocks over the last decade, most U.S. investors are likely very underweight international stocks relative to an appropriate long-term asset allocation. Fourth, international economies are adopting policies to address issues such as defense and reducing dependence on U.S. trade, which may stimulate their economic growth.

Bond Market Dynamics: Focus on yield rather than duration dynamics

A lack of Fed easing, the prospect of higher inflation, and the likelihood of fiscal stimulus have all put a floor under long-term interest rates in 2025, despite increasing signs of a slower economy. Long-term rates may remain range bound as the effects of a continued economic slowdown are counteracted by increased Treasury issuance in the wake of the passage of the reconciliation bill and an associated increase in the debt ceiling. For investors, there is not a strong argument for making a bet either on duration or credit in bonds. Even if the economy eventually weakens, any rally in bonds should be limited by rising federal borrowing and stubborn inflation. Moreover, at least in the short run, the economy will likely avoid recession, partially justifying today’s tight credit spreads. A roughly normal bond allocation continues to make sense in this environment – historically, today’s closeto-5% yield on the Bloomberg bond index has been associated with close to 5% annual returns over a 5-year period. Provided inflation fades late next year, these yields and potential returns seem reasonable.

The last few years have seen very strong stock market gains. However, that very outperformance could limit future returns. Moreover, the traditional role that bonds play in zagging when stocks zig has been challenged in recent years by higher inflation which negatively impacts both stocks and bonds. In this environment, a diversified portfolio should incorporate alternative assets, such as private equity, private credit, infrastructure and real estate. These assets are all quite different – some provide strong long-run returns, some generate strong current income and some act as good diversifiers to publicly-traded stocks and bonds. Many of them are quite illiquid and so should be thought of only as long-term investments.

Summary

The second quarter demonstrated both market volatility and resilience as investors navigated policy changes and global tensions. While the stock market ended the quarter at new all-time highs, the decline and rebound was challenging for many investors. For investors, maintaining perspective and focusing on asset allocation strategies remain the most effective way to achieve long-term goals.