Historic tax reform has arrived—again. On July 4, 2025, President Trump signed into law the One, Big, Beautiful Bill Act (OBBBA), a sweeping rewrite of the tax code. Whether you are a business owner, retiree, or working family, this law likely affects your tax picture for years to come.

Here’s what you need to know

Most of the updates (totaling 887 pages!) affecting individual taxpayers aren’t drastic. Rather, the bill locks in many of the 2017 Tax Cuts and Jobs Act’s (TCJA) core provisions that were scheduled to sunset after 2025—helping avoid potential tax hikes and planning uncertainty for many Americans.

“The most important impact of this new law is the stability it brings to major tax rules, which has been lacking for years.” said Charles Evangelakos, Founding Partner at Pallas Capital Advisors, LLC.

Several provisions essentially keep things as they are. The law does not change rules related to investment income or retirement savings. The maximum tax rate on long-term capital gains and qualified dividends stays at 20%, with an additional 3.8% surtax, and the current contribution limits and regulations for IRAs and 401(k) plans remain unchanged.

The alternative minimum tax (AMT) has been revised to prevent it from affecting millions of taxpayers starting in 2026. The 20% deduction for qualified business income from pass-through entities remains intact.

Additionally, certain deductions eliminated in 2017— such as the personal exemption, miscellaneous itemized deductions, and moving expenses for most f ilers—are now permanently repealed. The mortgage interest deduction continues to apply only to up to $750,000 of eligible mortgage debt, with no future inflation adjustment.

What are Some of the Major Changes in the New Tax Law?

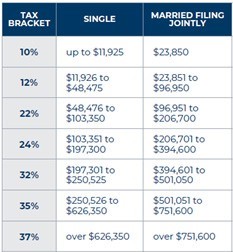

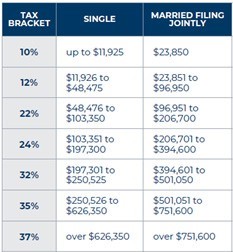

- The existing income tax rates and brackets are now permanently extended. There are no changes to the tax rates for long-term capital gains or qualified dividends. The 2025 brackets are as follows and will be indexed for inflation annually:

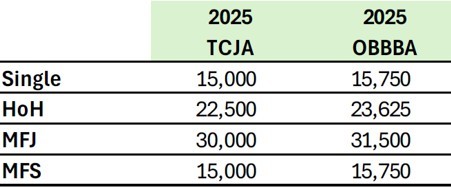

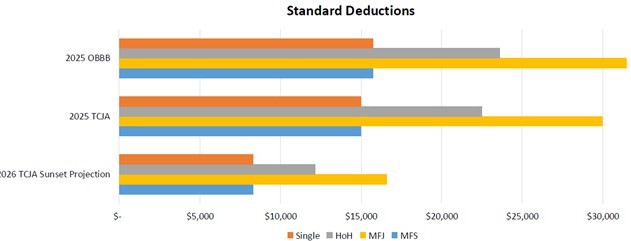

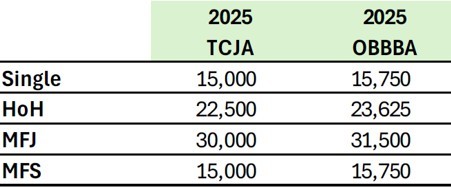

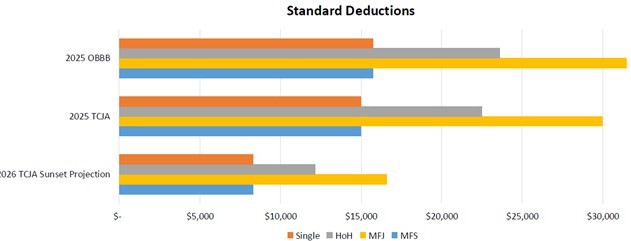

- The standard deduction, which was originally doubled under the TCJA, will remain in place permanently and will see a modest increase starting in 2025.

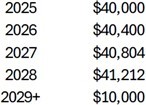

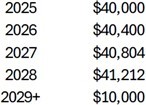

- The state and local tax (SALT) deduction cap is raised from $10,000 to $40,000 for the next f ive years, with a gradual phase-out once a taxpayer’s income surpasses $500,000. However, all filers will still be able to deduct at least $10,000. For 2025, the cap will be $40,000, and in 2026 it will rise to $40,400. Future adjustments are scheduled as follows:

- The bill incorporates the Trump campaign’s pledges to eliminate taxes on tips and overtime pay, but these exemptions apply only to individuals earning less than $150,000 ($300,000 for joint filers). These provisions are temporary and will expire after 2028.

- Starting in 2026, the lifetime gift and estate tax exemption will rise to $15 million per individual and will be indexed for inflation. This higher threshold is now permanent. What this means is that wealth transfer planning will likely take a permanent back seat to income tax planning for the vast majority of taxpayers.

- Social Security taxes remain unchanged. However, there is a new $6,000 additional deduction for seniors (age 65+) earning less than $75,000 (or $150,000 for couples), which will be available through 2028.

- For C Corporation Business owners, the expanded Section 1202 Qualified Small Business Stock (QSBS) definition offers an opportunity for significant tax savings. More information on this topic can be found on the following pages.

- The Qualified Opportunity Zone program will be renewed and expanded, becoming a permanent part of the tax code beginning in 2027. This initiative offers tax breaks to investors who direct capital gains into IRS-designated economically distressed areas.

- Tax treatment for municipal and private activity bonds remains unchanged.

- A new tax-advantaged savings account, known as a “Trump account,” is being introduced for individuals under age 18. These accounts can be used for various future expenses, such as education, home buying, or starting a business.

- Several green energy provisions are being cut short. To qualify for tax credits on new or used clean vehicles, the vehicle must now be placed in service by September 30, 2025, instead of the original 2032 deadline.

- The energy-efficient home improvement credit and the residential clean energy credit will now expire on December 31, 2025—seven to nine years earlier than previously scheduled.

- One of the more contentious aspects of the new law affects individuals who rely on Medicaid and related assistance programs. Eligibility rules for the Supplemental Nutrition Assistance Program (SNAP) are being tightened, requiring able-bodied adults under age 65 to work at least 80 hours per month. The only exception will be for those caring for children under 14. Before the law was signed, work requirements applied only to adults under 55, with exemptions for caregivers of children under 18. Starting in fiscal year 2028, some states will also be required to contribute to SNAP funding, which could place additional pressure on their budgets.